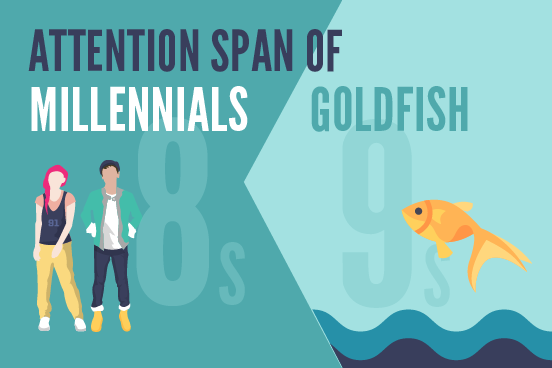

Millennials have an attention span of 8 seconds. A goldfish: 9 seconds. Here's how you can approach millennials and capture their attention.

According to BetterTradeOff’s “You'll have better luck holding the attention of a goldfish than a millennial”:

A study from Microsoft Corp. has shown that the attention span has dropped from 12 seconds in 2000 to a shocking 8 seconds. This finding is highly useful and no, it does not warrant lamentations on how millennials are forever glued to their screens (regardless of true this may be). This does however put pressure on financial advisers as the age-old methods of reaching out to the older generation may be rendered obsolete.

Millennials, also referred to as Gen Y, are those born from the 1980s through the early 2000s. The millennial generation is highly dependent on technology and they are accustomed to instantaneous acknowledgements of any achievements. They are often told how glib, torpid and entitled they are but it may not all be bad news as millennials are better educated than their predecessors, more ethnically diverse and more economically active. However, they do face greater challenges including economic uncertainty and exorbitant student loans than those who came before them.

So, what should financial advisers do to engage millennials?

Get to know them and think outside the box

This sounds fairly simple. Well at least for the first part. As a financial adviser, you already build and maintain relationships with clients. You understand and analyse their behaviours, goals, expectations, fears and essentially, be part of their comfort zone. Once you are seen as a valuable addition to their lives, trust and loyalty will follow undoubtedly. This concept remains the same for all generations but the approach changes.

How do you think outside this proverbial box?

Find the connection.

Millennials are considerable more open to discussing personal matters such as finances and investments but not in a structured setting. They generally prefer casual communication because they are scanners of information rather than readers. Overloading them with information is going to be futile for you and them.

“In an age where information is readily available with a single click of a button, advisers cannot only focus on providing information. This might have worked on older generations but today, they have to focus on adding value to the lives of young people and that will be the key to enjoying success in our industry,” Jeffrey Tan, Director of Synergy Financial Advisers, says.

One way is to target final year university students and fresh graduates. Although they will not have investible assets, it is a phase in their life that they would require help connecting the dots. You need to cultivate and maintain the new relationships through educating them and then, introducing them to the financial products that may be suitable for them.

Use your network shamelessly.

Remember that you’re dealing with millennials. A bunch of tech-savvy individuals who are probably more attracted to a fintech solution than you. The odds might be somewhat against you since the technology is cheaper, reliable, and more transparent. Fret not, because you do have a few advantages that you have to play up. In this age of digitalisation, your network of humans is a great asset.

Once you’ve created a pool of potential millennial clients through the networking events, keep track of milestones in their lives (should not be too difficult as millennials post even their most boring lunches on social media). If you happen to see a significant event (e.g. engagement pictures) on social media, take genuine interest and congratulate them. Connecting job seekers to employers, young entrepreneurs to investors are some ways that help to add value, authenticity and trust to your client relationships.

Serve without judgements.

Millennials are in the midst of making mature financial decisions – paying off student loans, buying homes, starting families, and supporting parents – all of which require your advice. With all of these in mind, start thinking strategically about the kind of products that you have to offer them.

"This generation also grew up with the Internet - no lack of access to information, education, world affairs and trends, and most importantly, social media. Thus, financial planning in the traditional sense may not be a priority for them, as opposed to pursuing the next travel experience, gastronomic affair or social cause. Financial planning for this generation involves engaging individuals on the basis of experience. They may not need to accumulate wealth (they probably will inherit it), but they may be more willing to engage in philanthropy or social enterprises with the like-minded," Mr Thomas Tan, Head of Wealth Advisory and Specialists, OCBC Bank, says.

When it comes to investing, millennials tend to be extremely socially conscious and driven as much by a desire to do good as to do well. A recent World Economic Forum study on millennials found that young people believe in ‘improving society’. This is the exact reason why there is a rise in impact investing. It is a multifaceted commitment to responsible investment as it fulfils the demand for both financial and social outcomes.

All pictures courtesy of BetterTradeOff