Consumers in Asia begin to save for retirement at age 40 on average, 54% regret not starting to save earlier and less than half believe their savings will last throughout their retirement, according to a new study by LIMRA Secure Retirement Institute (LIMRA SRI) and the Society of Actuaries (SOA).

The study found that more than three quarters of consumers in Asia expect to have a shortfall in retirement savings at age 60. In addition, consumers in Asia underestimate how long they will live in retirement by as much as 24%.

This combination of inadequate retirement savings and misjudging longevity risk creates a significant challenge for consumers to achieve financial security in retirement and poses substantial economic risk for countries in Asia.

The majority of consumers surveyed say they do not work with a financial professional to help with household decisions. Notably, this is significantly higher in Japan where only 1 in 5 households work with a financial professional. Across Asia, the study found 65% of consumers do not have a formal written plan for managing income, assets and expenses during retirement.

Read also:

Longevity risks increasingly being shifted to individuals

I turned 75 - more people should

R. Dale Hall, managing director of research, SOA, said, “Overall, the population over age 60 in Asia will triple by the year 2050. This will have a tremendous economic impact not just on the nations in Asia but also the global economy as a whole. Understanding how consumers in Asia perceive financial risks in retirement and the steps they are taking to prepare for retirement will be important as the industry develops the appropriate products and services to serve the local markets.”

Larry Hartshorn, corporate vice president, LIMRA International Research, said, “Our U.S. retirement research indicates that working with financial professionals and developing a written retirement plan significantly improves retirement outcomes. We are encouraged that attitudes around retirement planning are evolving. While most consumers ages 60-70 have done the least retirement planning activities, younger consumers are taking steps to estimate their expenses and income in retirement.”

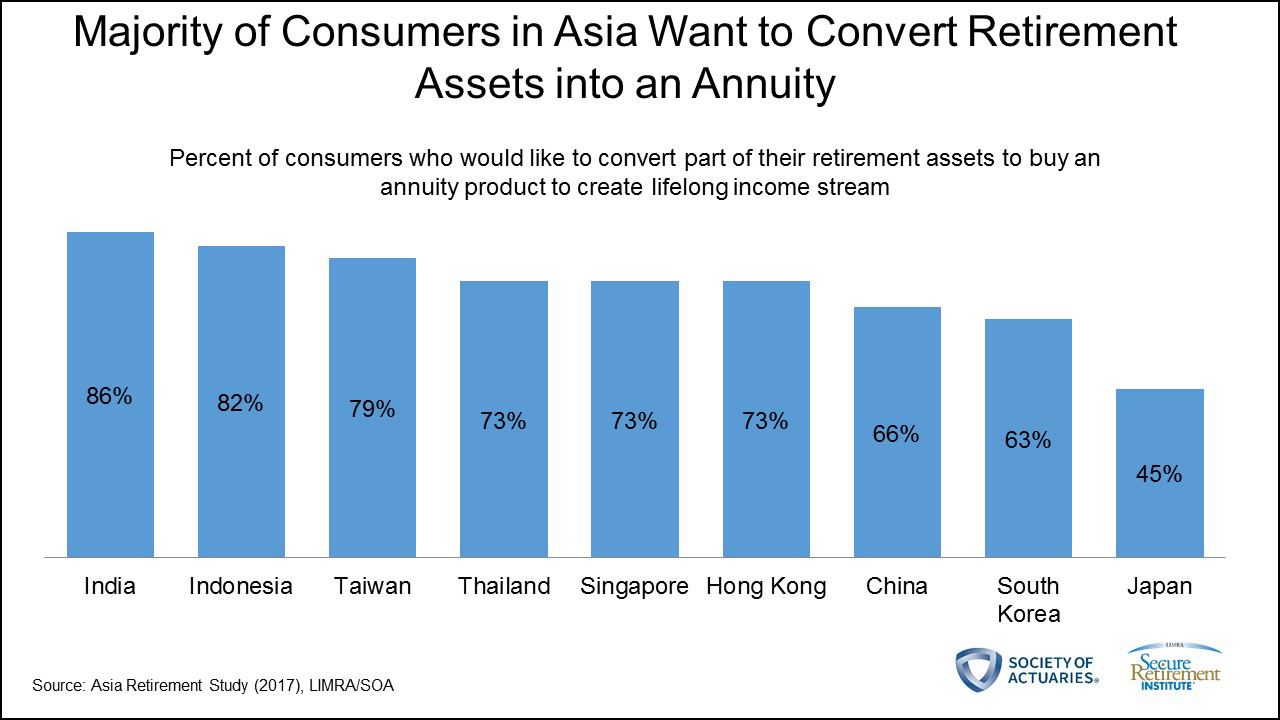

The study also revealed 7 in 10 consumers in Asia are interested in converting a portion of their assets into an annuity. The top three features most important to consumers were creating a guaranteed income stream, protecting or preserving their initial investment and guaranteeing returns on their investment.

“It is not surprising that annuities strongly appealed to consumers in Asia as they are concerned about outliving their assets in retirement,” said Hall. “Investing a portion of one’s assets toward a guaranteed lifetime income, such as an annuity, is one way to mitigate longevity risk.”

LIMRA SRI and the SOA conducted a survey of more than 9,000 consumers ages 30-75, across nine markets in Asia (India, Indonesia, Taiwan, Thailand, Singapore, Hong Kong, China, South Korea and Japan) to examine the current state and future opportunity of the retirement market in Asia.

Connect with Asia Advisers Network on Facebook, Twitter and YouTube.

Watch training videos on the go to grow your business. Produced in collaboration with Jensen Siaw International.