The Life Insurance Association Singapore (LIA Singapore) has launched its life insurance calculator, developed to help consumers gain a better understanding of their financial protection needs, and take steps to narrow their protection gaps.

This initiative underpins ongoing efforts to bridge Singapore’s 20% mortality and 80% critical illness protection gaps.

Mr Khor Hock Seng, President of LIA Singapore, said, “We tend to underestimate the probability of unfortunate events such as death and critical illness, and put off getting adequate protection until it is too late. By presenting this personalised gap in tangible numbers produced by an industry-calibrated calculator, we seek to encourage consumers to be proactive in ensuring that they and their loved ones are well-protected.”

Read also: Insurance market is saturated? Singapore's protection gap stands at US$672 bln

You may wish to try out the calculator here https://www.lia.org.sg/tools-and-resources/insurance-calculator-intro/. Following which you may generate a downloadable gap report, calculated based on the user’s existing financial resources and commitments.

Overview of mortality and CI protection gaps in Singapore

The life insurance calculator, coupled with the industry’s ongoing education efforts, is in response to the most recent Protection Gap Study (PGS) 2017, which found that individuals in Singapore have a national mortality and CI protection gap of S$893 billion. This equates to an approximate S$169,673 mortality protection gap and S$256,826 CI protection gap per economically active adult.

Read also: Singapore: LIA announces changes to Critical Illnesses definitions and names

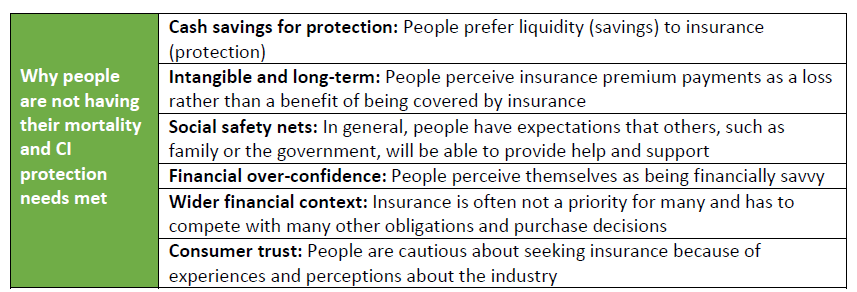

A follow-up qualitative study conducted by the Association revealed that the significant protections gaps were due to several perception barriers such as seeing insurance premium payments as a loss rather than a gain, and financial over-confidence where individuals believe that they are financially savvy.

(Credit: LIA Singapore)

Members of the public are highly encouraged to use the life insurance calculator and start conversations with a financial adviser on how they can be adequately protected at every stage of life.

Recommended for you:

AIA Singapore launches comprehensive critical illness plan with protection from "pre-early conditions" to all stages of critical illnesses

Singaporeans not optimistic about their financial future

IFPAS celebrates its 50th Anniversary milestone

For the full suite of stories and updates, always check in to our Facebook / LinkedIn. Click the following if you want to improve your sales, learn how to be a better leader, or you just need some motivation to kick start your engine.