Prudential Singapore has launched a new supplementary hospitalisation plan, PRUExtra Preferred CoPay.

The premiums for this new plan are 30 per cent lower than Prudential’s existing private hospitalisation plan, and gives customers access to medical treatment at public hospitals and private hospitals, such as Raffles Hospital and Mount Alvernia Hospital, under its PRUPanel Connect (PPC) programme.

For medical treatments at the two private hospitals, there is no need to receive pre-authorisation from the insurer before proceeding with the treatments. This means policyholders can seek treatment more speedily and enjoy the choice to consult with medical practitioners and specialists from Raffles Hospitals and Mount Alvernia Hospital.

Prudential Singapore’s Chief Customer Officer, Goh Theng Kiat, said the insurer’s latest hospitalisation plan fulfils a gap in the market.

(Source: Prudential Singapore)

He said, “Across the industry, premiums for private hospitalisation plans have been increasing due to rising medical inflation in Singapore, which was projected to be 10.1 per cent in 2019. PRUExtra Preferred Copay is a ‘best-of-both-worlds’ solution as customers can access quality private healthcare for much less.”

4Cs with PRUExtra Preferred CoPay

Customers of PRUExtra Preferred CoPay enjoy a cashless and convenient experience, with a wide choice of healthcare providers and expense cap.

Cashless - Customers receive cashless medical services of up to S$30,000 at Raffles Hospital and Mount Alvernia Hospital.

Convenience - On-site concierge services are available at both private hospitals to providence guidance on claims submissions and assist customers on PRUShield-related queries.

Choice - Choice of over 300 specialists serving the two private hospitals and public hospitals to seek consultation and treatment from.

Cap of expense - Customers have peace of mind knowing that out-of-pocket expenses are capped at S$3,000 for PPC providers.

An added benefit is that the multiplier on the plan’s claims-based pricing is more gradual than Prudential’s other plans. With claims-based pricing, customers who stay healthy and claim less have the opportunity to pay less for their insurance.

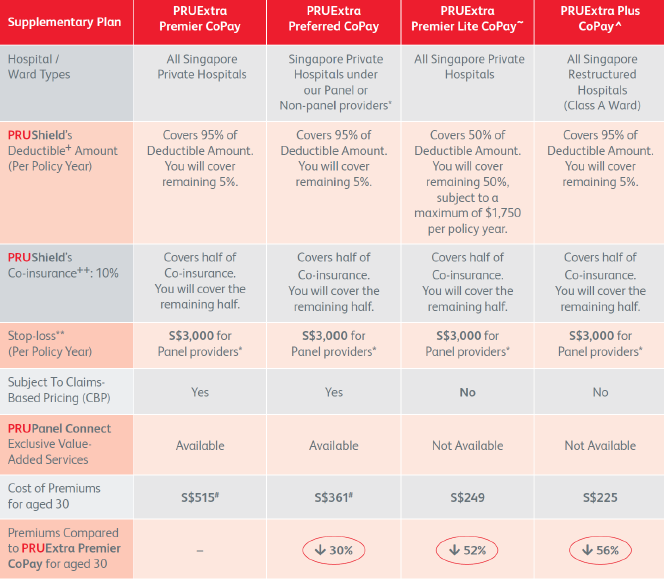

In addition to the Preferred CoPay plan, customers can also choose from the insurer’s suite of supplementary plans. This includes the deluxe offering PruExtra Premier CoPay which provides 95 per cent coverage at any hospital in Singapore, PruExtra Premier Lite CoPay plan with lower coverage at more affordable premiums, and the PruExtra Plus CoPay plan for those who prefer to seek treatment at public hospitals.

To ensure healthcare remains affordable to its customers, Prudential is lowering premiums for PRUShield Plus, its base public hospitalisation Integrated Shield Plan, by 10 to 31 per cent. This applies to nearly 90 per cent of the insurer’s existing PRUShield Plus customers, and takes effect from 1 April 2020.

PRUShield’s suite of product offerings at a glance

(Source: Prudential Singapore, info accurate as at 1 April 2020)

See also:

Confined to a wheelchair but not resigned to fate

AIA Singapore extends medical claims pre-authorisation to give clients peace of mind

Data & Analytics: An Insurance Perspective

Connect with us to get the latest: Facebook / Instagram / LinkedIn / Soundcloud / YouTube /